Services

A wide range of equity research outsourcing services, from support tasks to writing complete equity research reports with valuation

We offer a wide range of equity research outsourcing products to suit the needs of our customers. Note that we do not demand credit for products created by us (only payment), and you will retain full rights to any work we do for you (as long as it has been fully paid). You will own the copyright and we will not distribute the work to anyone else. We will maintain full confidentiality (we recognize that outsourcing may be a sensitive issue to some customers).

Moreover, our pricing is very flexible as we consider each client’s circumstances on an individual basis.

We offer the following financial outsourcing and valuation services:

Startups & Private Equity Research and Valuation

We have extensive experience working with private equity investors, including VCs. Our services include investment reports with financial models and valuation, and investment memorandums. We analyze both startups and established businesses, and these can be both in developed countries and in emerging markets.

Read more about our work with startups...

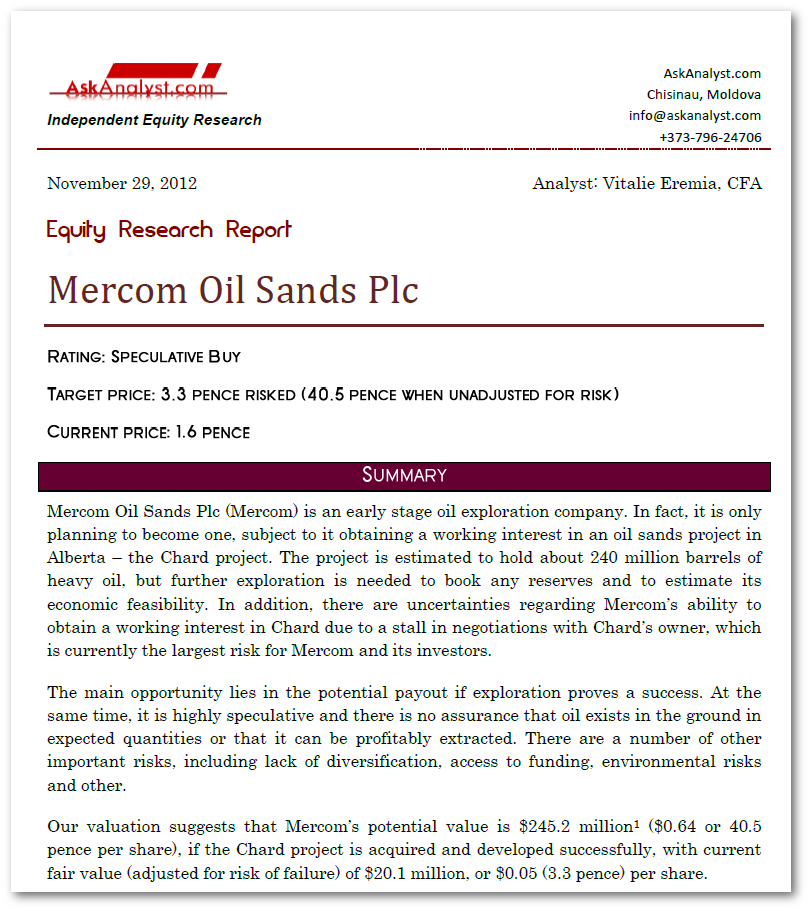

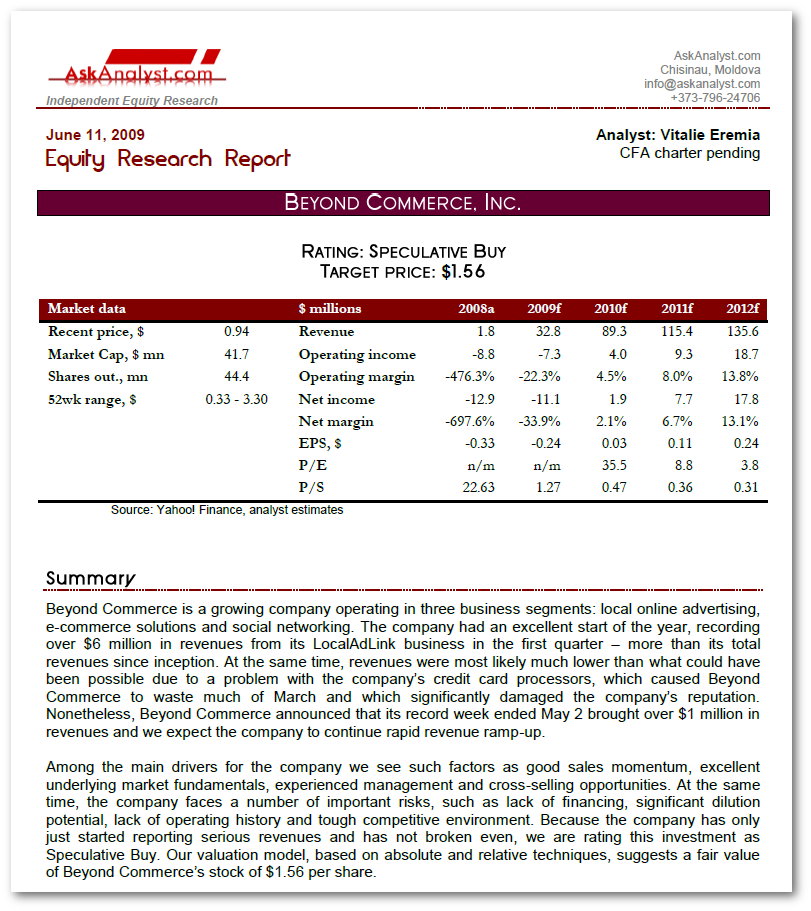

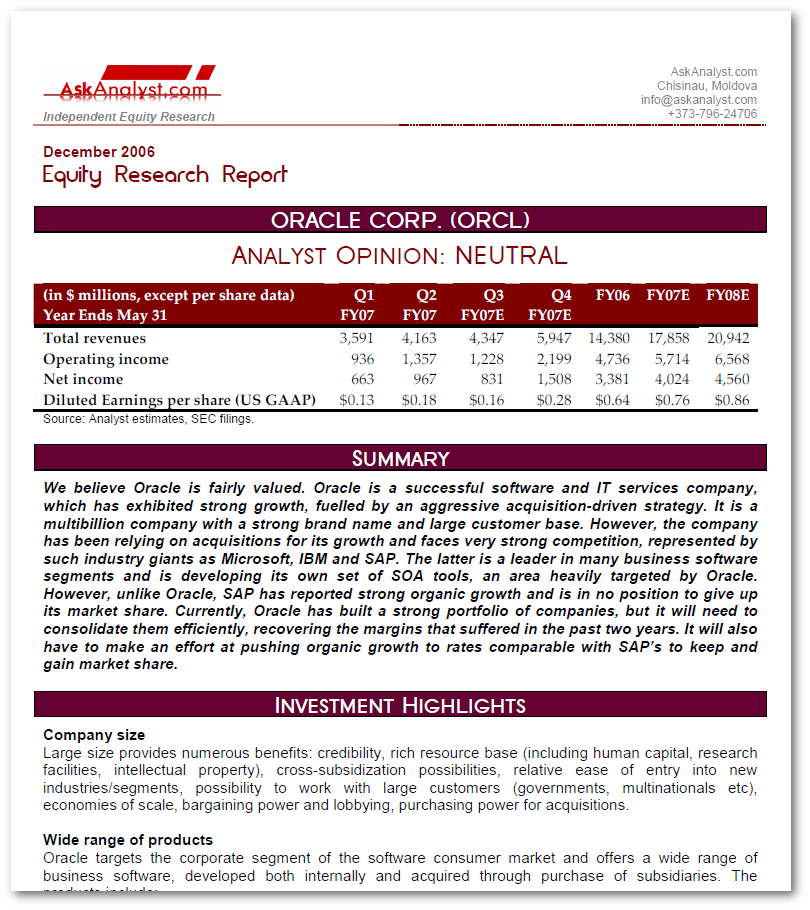

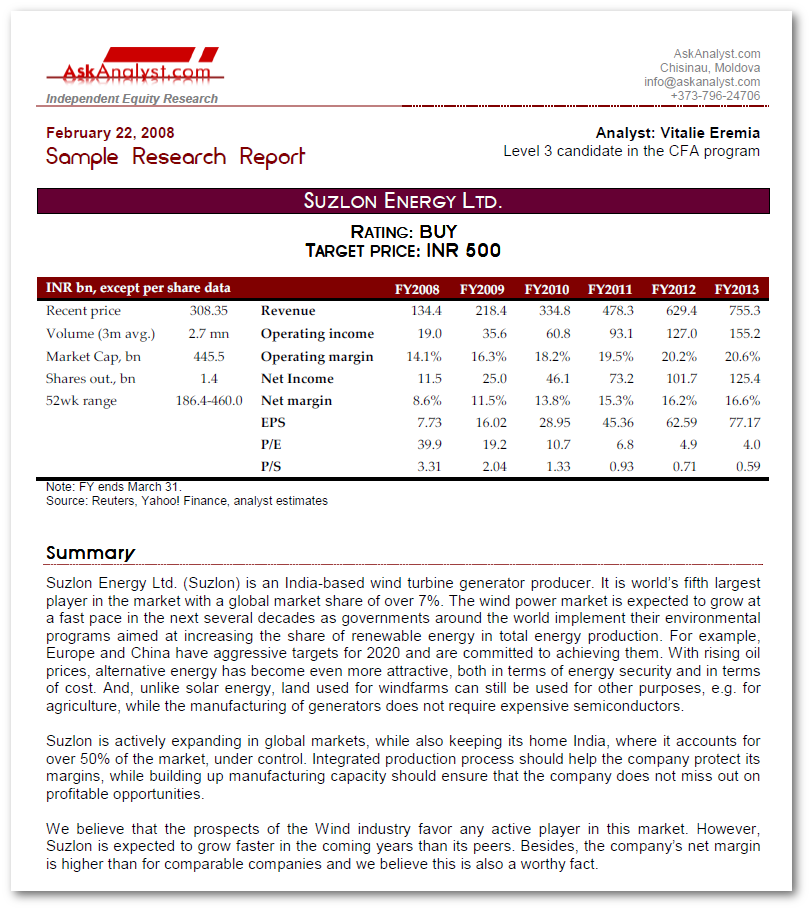

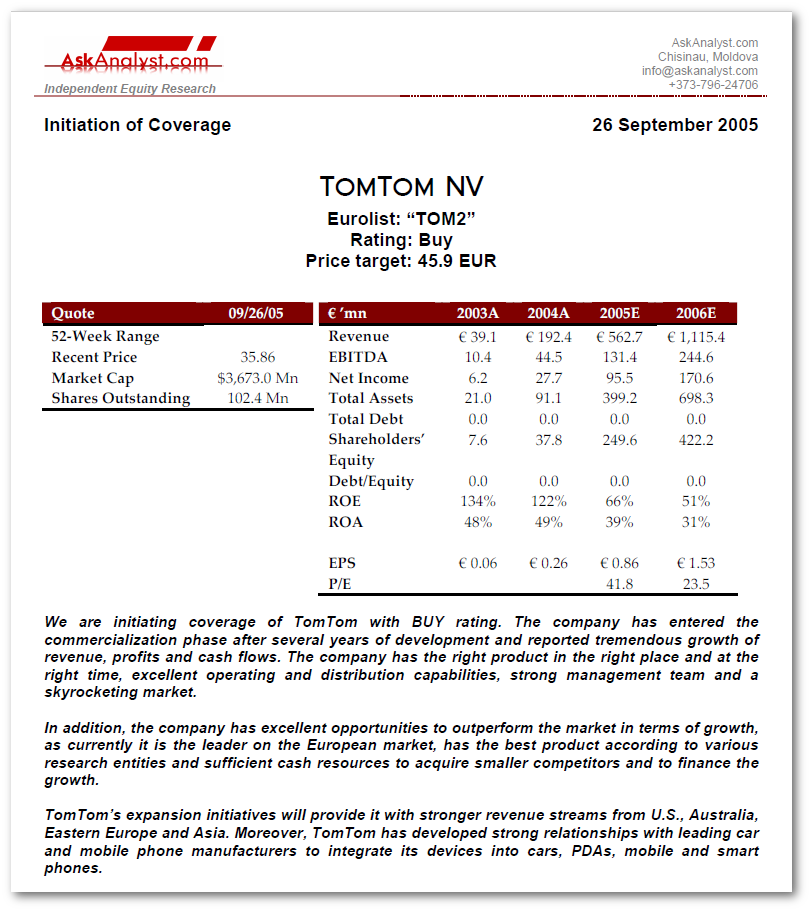

Public Equity Research and Valuation

We offer a wide range of equity research outsourcing services, from support tasks to writing complete equity research reports with valuation.

Our typical equity research report spans 20-30 pages and contains detailed analysis of a stock. We also fill historical models, gather data and do other research assignments for our customers.

Read more...

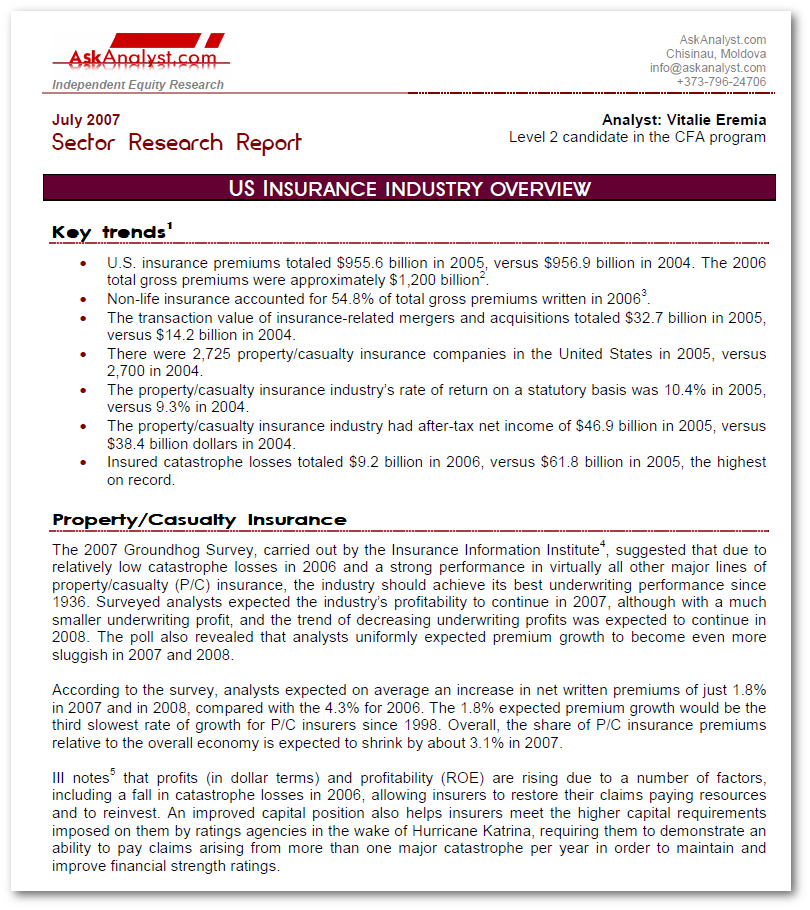

Industry/market research

Market/industry research is an integral part of equity research and valuation and we regularly research various markets for our equity research reports. We perform in-depth market research. Note that this is secondary web-based research, using publicly available information from various sources. We always include the sources we use, so you can always verify where the information comes from.

Read more...

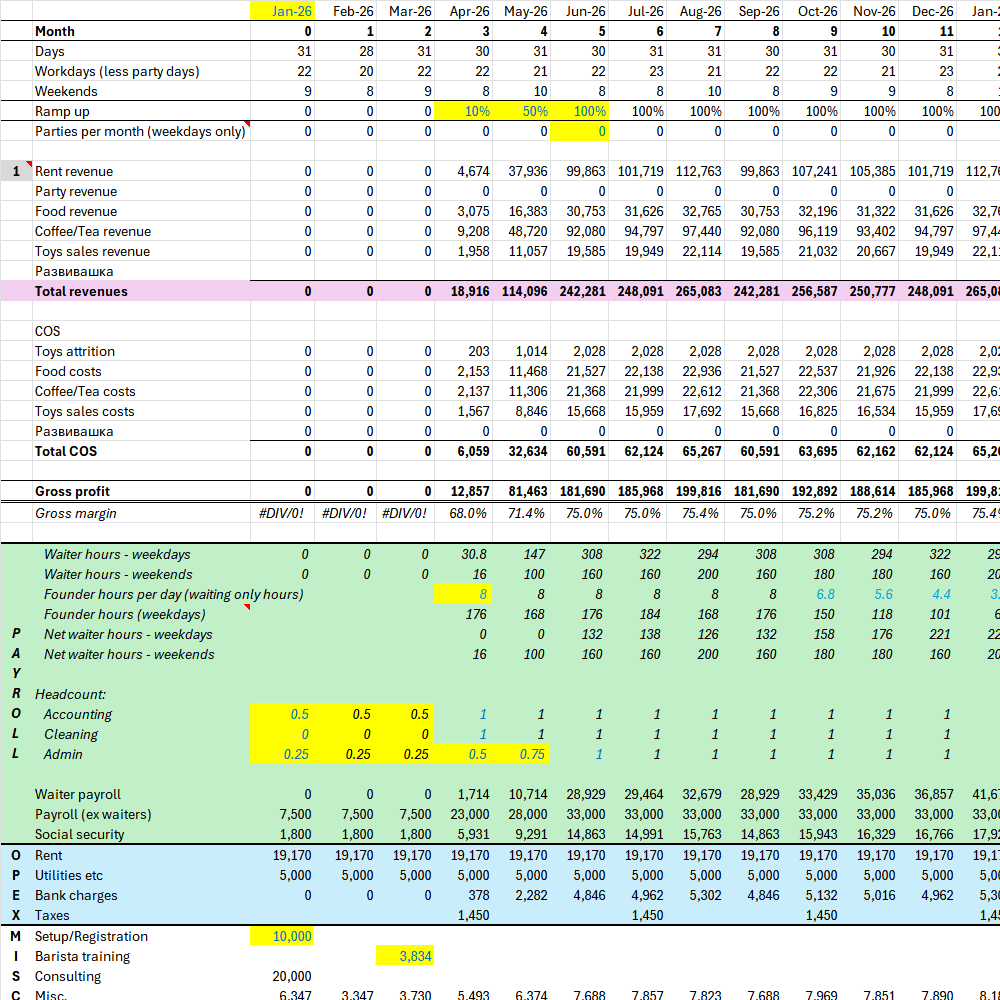

Financial modeling

We have extensive experience in financial modeling. We have built models of publicly traded companies, private businesses and startups, for the purposes of valuation, business planning, fundraising etc.

If needed, our models include sensitivity analysis, scenarios, presentation charts and tables, and even custom functions and macros.

We build our financial models in the latest version of MS Excel. All manual inputs are always clearly labeled and the logic for projections is always explained.

Historical models

We have built thousands of historical financial models for our clients. Whether you need data pulled from SEC, SEDAR, AMF, LSE, ASX or any other public database or a company's own website, we can do it quickly and error-free. Our expertise in this field and proprietary tools mean we can do this faster than pretty much anyone else, while our financial background means we know what to look for in filings and reports.

We can often work with non-English language filings.

Excel & Data Entry

We use Microsoft Excel extensively in our work to analyse companies, value them, build tables and charts for reports and presentations and for internal needs. With this expertise, we can offer you a wide range of services involving the use of the powerful spreadsheet package that Excel represents.

We regularly sift through SEC filings, press releases and other documents in search for important information. Importantly, our financial background and experience allow us to execute such tasks thoughtfully, understanding what we’re doing and not simply executing work mechanically like robots. We also usually know where to look for particular data. We are also efficient at importing data into Excel from PDF files.

Read more...

Analyst Support

We also can take care of various support tasks related to financial analysis and research:

Search for information

Financial modeling

Preparation of financial documents

Consulting

Other tasks

Please contact us for specific requests.